|

We're pleased to opening booking for 2 Arts Council England funding workshops aimed at producers. These workshops are part of our ACE funded project Producing For The End Of The World, supported by partners Battersea Arts Centre and Theatre Bristol. We have a long history of writing successful Arts Council funding bids, and in this past year have raised £239,000 for arts freelancers, including numerous successful DYCP applications. We're looking forward to sharing our experiences and hope the sessions will be helpful! Thursday 15th April, 10am-1pm, FREE

Prjct Grnts shrtcts 4 prdcrs Book now A session specifically for producers who have or plan to write under £15k ACE Project Grant applications. We’ll share some of the shortcuts we’ve developed to getting an application done as painlessly as possible. We will look at templates to make the writing quicker, share our processes for information gathering and complete some writing tasks to help build your confidence and ease with hitting that word count! Who is it for? This will be skills focused rather than introductory, so this is aimed at people who already know the sorts of things ACE fund and are looking for practical tips on application writing. The session is pitched primarily at producers who are less confident in writing Project Grant applications, but if you are a more experienced producer and would like to attend please feel free to come along. If you are a self-producing artist you’re also welcome, just be aware that the session will be more focused on producers. Access: The session will be hosted on Zoom and will be live captioned. --------------------------------------------------------------- Wednesday 5th May, 10am-1pm, FREE DYCP if your P ain’t very C Book now A session specifically for producers who might want to apply for their own DYCP funding. We’ll think about how we can talk about our own practices as C(reative) even though they might seem mostly administrative. We will do an introduction to DYCP, talk about the type of application formats we’ve had success with and spend some time doing practical writing tasks. Who is it for? The session is pitched at producers who are interested in applying to DYCP for their own development. Access: The session will be hosted on Zoom and will be live captioned.

1 Comment

You can listen to the full post below here, or read on:

As part of our Producing for the End of the World project we’re offering £600 to two Early Career producers to join us (The Uncultured) for 6 mentoring sessions. Watch this video to find out about the opportunity, then continue reading below. You might want mentoring from us because:

- You have some aims and plans you want strategic support with - You’d like to learn something specific that you think other producers (us) could help with - You’re not 100% sure but know you would benefit from some open conversation - Shit’s Hit The Fan and you need this. Who 1. You must be a producer with at least one year of experience, and you should define yourself as Early Career. 2. You can be based anywhere in the UK. Mentoring sessions will be held over zoom between March - July 2021 at times mutually agreed by us and you. 3. We are live art/performance producers and so would like to support others in this part of the sector. 4. As we are two white cis women, we really would like to reach producers who identify differently to this. 5. If you don’t know who we are, please take a look at our website the-uncultured.com and watch the intro video above to see if you think you’d actually like to spend 6 hours or more on a zoom with us! How to apply Please send us either an up-to-date written, video or voicenote CV, a website link or portfolio link to apply. This is so we can double check you meet the criteria of being a producer with at least one years’ experience, are based in the UK and are working in live art/performance. Send your CV/Link to [email protected] If you meet the criteria, your name will be put in a hat and randomly selected. Because of this random selection process we will be unable to offer feedback. When Deadline for applications is 9th March at 5pm. Late submissions will not be entered. You can listen to the full post below here, or read on:

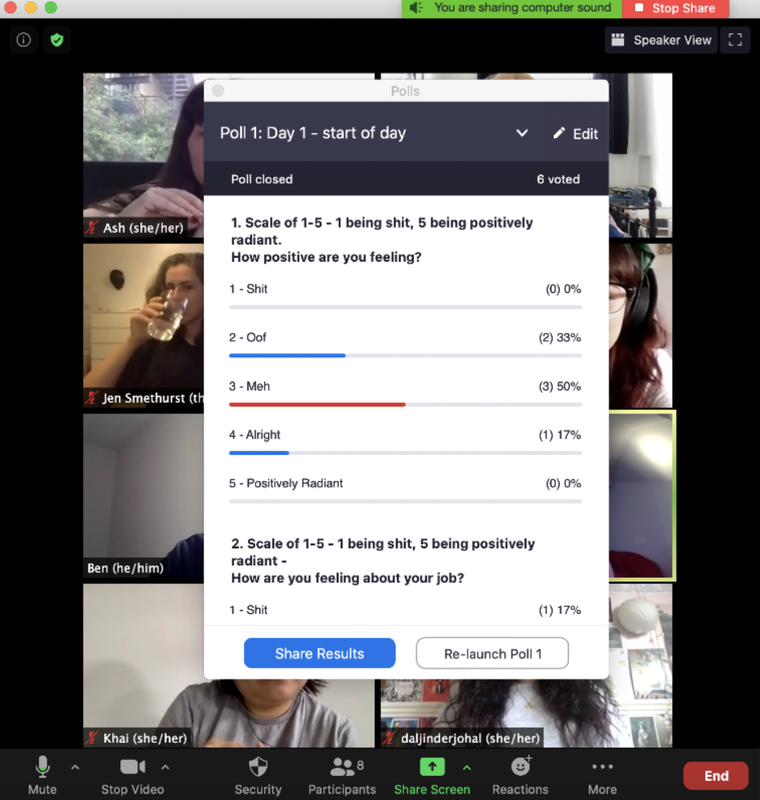

(Length: 4 mins) We’ve eaten all the beans, flushed the last sheet of toilet roll and moved into our pillow-fort bunkers, but it still doesn’t quite seem to be the end yet. Making something arty “happen” right now is almost laughable, but we’re going to roll up our sleeves, pop on our masks, and take a big deep breath of our own recycled oxygen and work out how the fuck to take a next step. 2020 was...different, and 2021 looks to be much the same. Live performance will be altered for the foreseeable future. Smaller audiences, socially-distanced ways of working, increased international tariffs, and fewer opportunities and fees available from venues. Freelancers of all forms have had to adapt quickly, without resource, knowledge or skill in order to make money or not get left behind in the shuffle. Live work producers are trying their hand at new ways of working and finding that the answer to most things seems to contain the word digital. Have-a-go culture leaves artists and producers exposed and on the back foot, and could potentially do more harm than good. In 2020 we had a go at a zine, a film, a novel, online talks, an exhibition and a web-based artwork. We had to make it up as we went along, it was stressful, things were missed, and we don’t want to do that any longer. So thank fuck ACE has given us some money to think about better ways of working in the coming year. Yeh, but HOW did you actually do that? We guessed, pulled in favours, made mistakes and spent a lot of unpaid time trying to learn a bit. We can’t, and don’t want to retrain as film, podcast and digital producers, because there are already people doing these jobs brilliantly. But to be able to continue working with artists, and supporting increasingly interdisciplinary ways of working, we need to know enough to support bringing together the right teams and importantly, the right amount of money, to create positive processes and well resourced work. For the next few months we’re going to be speaking to organisations and freelancers who have made adaptations to their business as usual in order to keep making work happen in 2020/2021. We want to find out what they’ve changed, what ideas we can learn from, what ideas we can borrow or steal and which of their mistakes we can try to not replicate. We’re all having to react and work differently and we feel we need to combine this individual learning as much as possible so that the wider ecology of artists and arts workers can benefit from it, use it, and better it. Our collection of case studies will go into a publication. It will be a by-no-means-exhaustive set of crib sheets for the ways that people have swerved, shifted and kept shit happening during the pandemic. We hope it will give a reader a collection of provocations for ways of working during the next inevitable political, financial or health shitstorm. Other things we’re going to do: - A paid mentorship for 2 Early Career Producers working in Live Art and Performance - A three-day workshop for Live Work Producers who have had to undo and redo most of their work over the past year - Host bi-monthly Live Art and Performance Producer drop-in sessions - Funding advice sessions including: ‘DYCP if your P ain’t very C’, and ‘Prjct Grnts shrtcts 4 prdcrs’. In partnership with Live Art Development Agency and ArtHouse Jersey. Participants: Ben Price, Beth Sitek, Daljinder Johal, Jen Smethurst, Nur Khairiyah Ramli, Roxanne Carney, plus Ashleigh Bowmott and Laura Sweeney. This 3-day remote retreat was for 6 producers, curators and arts administrators who had had to undo their present and future work because of COVID-19. It was a guided staycation which allowed space for those who ‘support’ Live Art, to reflect on “business as usual”, get some much deserved socially-distanced nourishment, and develop some collective radical terms and conditions. Each participant was given a stipend of £140 to take part. Day One - Doing The first day focused on reflecting on the groups’ practices pre-COVID, and involved contemplative walk and talks and collective screams. Through small group and whole group discussion they explored notions of Value and Sustainability. In order to understand individual situations through a collective lens, each participant spoke of their frustrations about their practices and through active listening created a word cloud to highlight the shared themes. Day Two - Undoing This was a compulsory day off. In order to facilitate this, we posted some ‘shiny ass care packages’ beforehand to each participant. This included a suggested day-off timetable; a podcast, YouTube rabbit hole, and Netflix list; cookie mix; face masks; clay; aromatherapy roll ons; and shower steamers. The group on Zoom sharing mementos of their day off including items made with clay, a hoover denoting time dedicated to cleaning, and a selfie with a face mask on. Day Three - Doing Again This final day was broken down into three sections about Boundaries, Money and Work/Life Balance. It involved a gameshow, an unexpected hour off, group conversation and the development of new Terms and Conditions for working. At the end of the three days, each participant said goodbye to one another in the form of a promise to their practice. These included: - Not working unpaid again, at the risk of undermining themselves and others in the workforce. - Valuing their practice as much as those that they work with. - Setting clear boundaries. The group on Zoom, in the middle of a statistic based Higher-or-Lower gameshow. “I think the best thing about this DIY is that it was for a job role that is very cloudy, and it was useful because the process was about demystifying. I don’t know any other job roles in the industry which face this as much as producers” Workshop Participant “I think the 3 day staycation was really valuable, well planned and there's nothing I could think of that I want more of. I honestly didn't want it to end, and wish we could repeat what we experienced next week. So every Tuesday-Thursday I get to check in and just have that space to talk and listen.” Workshop Participant “I felt totally seen & it was a very comforting process that I definitely needed.” Workshop participant We made it clear that we needed this DIY as much as the participants did. As such it was structured as a space of careful reflection, discussion and appropriate rest. We wanted to ensure it was lighthearted and warm, at a time where everyone has lost much of their work and self-care has given way to self-preservation.

We were involved in a recent survey of independent producers which shared a report available here, demonstrating the lack of opportunities specifically for those in supporting roles, and the inconsistent training and networking platforms which become barriers to progression. There are so few networks, funding streams and support networks aimed specifically at those who ‘support’ live art, directly leading to the sense of loneliness, lack of value and burnout that is cited in the word cloud produced on Day One. We believe this is mostly preventable, and that targeted learning and development opportunities for producers, curators and arts administrators is key to ensuring that some of this talent remains in the industry.

Today Arts Council England have re-opened their Developing Your Creative Practice (DYCP) funding stream and we've updated our Word doc template which you can download above.

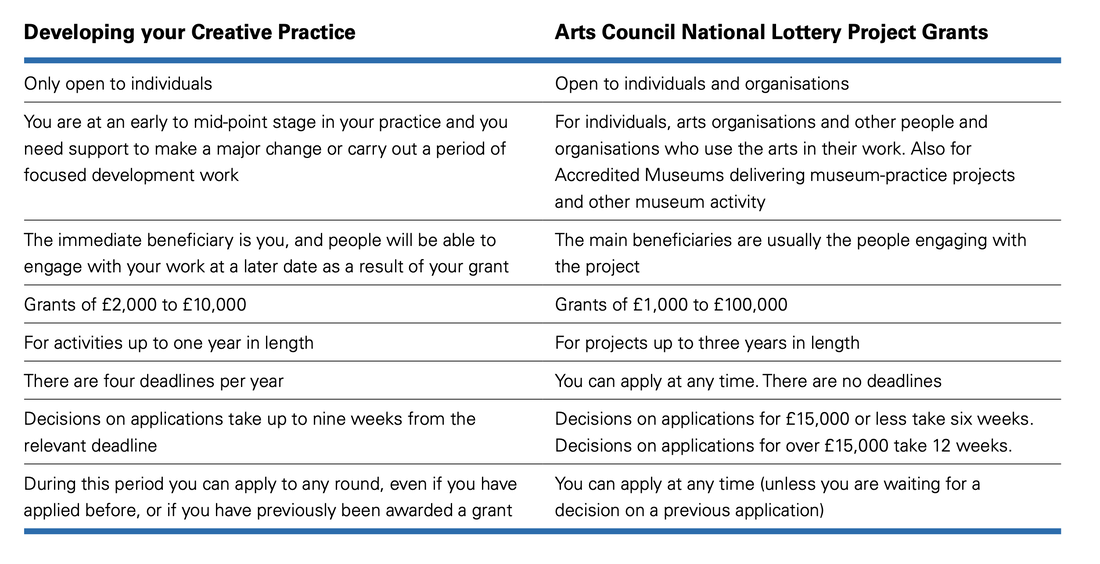

Read the full guidance notes on ACE's website here. Summary of funding and any notable changes: Overall budget for this funding Increased budget of £18 million to distribute over the next 12 months (October 2020 to October 2021), across 4 rounds. Who is this for? ACE have expanded the definition of who can apply: "What do we mean by creative practitioner? The list included in the guidance has now been expanded to include DJs, performer/creators, arts and cultural educators, community practitioners/engagement specialists, movement directors, cultural conservators, creative enablers, creative technicians. You also now only need to have had one years’ experience outside of a formal educational setting. If you’re working in one of our supported artforms or disciplines and don’t see yourself in the list, get in touch and we can let you know if your practice is something we can support." If you work in film, video and audio, see the guidance notes for a breakdown of what can be support and what can't. How much can I apply for? You can apply for between £2,000 to £10,000. What is the turnaround? Decisions from this first round will be the week commencing 21st December 2020 (up to 9 weeks). What can I apply for? Activities can be up to one year in length. "Some examples of things you can apply for are: • building new networks for future development/presentation of work • creating new work • experimenting with new collaborators or partners • international travel to explore other practice or work with mentors • professional development activities • research and development time to explore practice and take risks • taking time to reflect on the impact of Covid-19 on your practice and practical steps to support your work to be more sustainable in future" Check out these case studies for ideas. But will I get it? "Applicants must show a clear development plan to be eligible for this programme. This is a competitive programme – we receive many more good applications than we are able to fund. Strong applications are those that can demonstrate a real impact on people’s cultural and creative development in England." How many times can I apply across the year? "Previously, you could only apply to DYCP twice within a 12-month period. But between October 2020 and October 2021 there are no restrictions on reapplying to DYCP. You can still only make one application per round. But if you’re unsuccessful you can apply again in the next round, there are no restrictions on how may rounds you can apply to." Can I apply again if I've already had DYCP funding? Yes! If you’ve previously been successful, these restrictions have been lifted too so you can now apply for any and all round of DYCP in this period. Can I apply if I have a current Project Grant application? Yes! As long as you've had your decision. Are the questions different now? No, just a few additional tick boxes relate to Let's Create strategy, public engagement and socio-economic status for their evaluation. Should I apply for DYCP or Project Grants?

You can read the intro blog post here, or listen to it on the

Soundcloud playlist at the bottom of this page, along with a voice recorded version of the 'Freelance Supporters Menu'. (ORGANISATION SPONSOR EDITION) VERSION TWO - SEPTEMBER 2020 The Freelance Task Force was set up to strengthen the influence of freelancers, amplifying the voice of this majority workforce and creating better, more sustainable, more equitable relationships between freelancers and organisations in the theatre industry. This menu has been designed for organisations to choose ways that they will commit to supporting freelancers and the wider sector in the long and short term. It provides a series of provocations, collated from some of the research emerging from individuals on the Freelance Task Force and will be offered for consideration to the Freelance Task Force sponsors first, before being disseminated nationwide. As a Freelance Task Force sponsor, you have already signalled your commitment to the majority workforce. This menu offers a series of thought exercises to direct your action following your commitment. This is one of a plethora of documents to be compiled during the Freelance Task Force, and is one seen through the eyes of those who have pulled it together - Ashleigh Bowmott and Laura Sweeney of The Uncultured. That means it is not a comprehensive assessment of all of the work to have taken place. There is more information available on other Freelance Task Force work at freelancetaskforce.co.uk. This is a living document that will point to some of the work that was and continues to be undertaken by members of the Freelance Task Force throughout summer 2020. This is version two. There are “big ticket items” which offer provocations to support you in making purposeful decisions to lead your organisation with imagination for the long term improvement of working conditions for everyone. There are also “small ticket items” which will enable you to proactively participate in change with some short term improvements. These will incrementally enable fairer practices across the sector. You might also choose a pick and mix of some or all of these menu options. We recommend that you consider at least one big ticket item, and at least three small ticket items to get you started. For example you might choose “Access” as a big ticket item, and then “Anti-Racist Practices and Accountability”, “Management” and “Redistributing Organisational Funds” as small ticket items. Consider each of the provocations within these sections, refer to the further reading, and source some extra reading of your own. We encourage you to put aside some time to work with the freelancer you have been sponsoring to discuss these ideas in depth. This time will need further remuneration if the contract you had with that person has ended. They can act as your expert, a critical friend, who can then signpost you to others who can support you in particular areas that will strengthen your business with the majority workforce at its core. Those who are conducted this research within the Freelance Task Force want to support your exploration and implementation of this organisational development. They need to be paid to do so. All of these options are anchored in kindness and freelancers are watching your moves with compassion. Some of these menu options will be difficult to work through, but we encourage you to think through why some of them might make you feel uncomfortable and push into that. In this world-shifting time, place everything on the table without assumptions and rigorously critique your practice. Ask others in your organisation to contemplate this menu, ask peers who can support you in making brilliant albeit difficult decisions. Consider what it will mean for you to make bold and radical moves for the benefit of more people as you are part of shaping the next practice of theatre. This document has been compiled by Ashleigh Bowmott and Laura Sweeney of The Uncultured with input from Beccy D’Souza, Lily Einhorn, Victor Esses, Daisy Hale, Gillie Kleiman, Polly Jerrold, Lora Krasteva, Kate O’Connor, Rachel Mars, Emma Jayne Park, Beth Sitek, Paula Varjack and Leo Wan of the “Burn it Down - Radical Task Force Working Group”. It mentions the work of a plurality of voices from the Freelance Task Force. Or listen to a voice recording of each chapter on the Soundcloud playlist below. You can listen to the full post below here, or read on:

(Length: 14 minutes) The Freelance Task Force has come to an end of it’s 13 weeks. For those of us who have an interest in worker politics and believe that advocacy around freelancer sustainability is an intrinsic part of our roles, the “work” of the Task Force was not new, and also will not end here. However, having this work formalised under a recognisable moniker, and also having it valued through payment has offered a sense of legitimacy to this work that I had not previously experienced. This is not to insinuate that legitimacy is only attached to recognition and payment, but rather that it has been a tool through which to communicate with an audience who tend to attribute value through recognition (eg your affiliation with an organisation they know) rather than through excellence (eg taking the time to listen to individual perspectives accounting for their intersectional knowledges). Freelancers are individual workers by their very nature and therefore don't have the luxury of a hyperreal brand personality through which to wield influence. Rachel Mars described being part of the Task Force as like having a little power jacket to put on. For me this demonstrates the most powerful illusion of working collectively, even if that collectivity is structured through difference and individual interest. This little power jacket is sewn with a thread of threat, a thread of "there are more of us than you, and now we have our own channels of communication". Through the structure of sponsor organisation payment, each organisation has financially declared their belief in this process. For these purposes it matters less whether they actually believe that the whole system should change and that freelancers should be better supported, and more that they have paid for the cloth that has been cut into 160 or more little power jackets. I haven’t checked with Fuel, but with some fag packet maths it seems it cost around £400,000 to run the Task Force for a total of 13 days. This is a significant investment by any project standard (obviously a drop in the ocean in comparison to the upcoming 2022 celebration of nationalism and xenophobia, but that would be an extreme example whatever the financial weather). This investment has secured direct employment of around 160 individuals. At this point in time I feel it is not hyperbole to acknowledge that this is 160+ mouths fed, 160+ rent or mortgage payments made, or 160+ people’s expertise remaining in the industry just a little longer. The Task Force outputs have been multifarious, and I only really know about the things I've had involvement in. That comes with some sadness, but also some ambivalence due to the recognition that I don't have to be involved with everything and that everyone being involved or even aware doesn't automatically equal success. Laura and I have been directly involved with the Freelance Supporters Menu (developed with support mostly from the phenomenal "Burn It Down" working group), the Producer Survey and resulting data report (with a selection of great producers, driven by fan favourite Dais Hale), and the New Ways workshop (led by Gillie Kleiman). The Task Force has also given us the opportunity to create otherwise impossible connections between geographically and disciplinarily dispersed freelancers. It is possible that this has been the most transformative aspect of the project for me. It connects us out to dispersed and diverse knowledges I didn’t even know I needed to have relation with. For 13 days work this is remarkable. It is, I feel, significant value for money. This should not, however, obfuscate what a complexly difficult and damaging process the Task Force has been. The closed-door recruitment processes and disparity in wages for the exact same work ensured that the Task Force was built on inequitable foundations. There were consistent disagreements amongst individual members of the Task Force, as power dynamics demonstrated that they are a problem of privilege rather than a problem with organisations as a concept. The same damaging structures were created with absolutely no thought or critique. People of colour were repeatedly silenced. Deaf and disabled colleagues were left with barriers to their access. Administrative capabilities became the language of power through which others could be silenced by circumstance and therefore excluded from participation. To counter this, some of the more benevolent members of the Task Force made their entire workload about questioning and trying to dismantle these power grabs. Some of the final “full” Task Force meetings were framed as check-ins of care, rather than about forwarding solutions, answers, and outputs at an inhuman accelerationist pace. As mentioned in a previous blog post, Laura and I received £150 a day remuneration on a job share, therefore £150 x 6.5 days each. In reality, we did more work than this. The added hours brings our day rate down to somewhere in the region of £55 a day. I welcome anyone salaried to tell me the last time they knowingly worked for around £55 a day. To help out that’s £6.87 an hour which I think is just slightly under what I earned when I worked in HMV 14 years ago at the age of 19. I welcome anyone salaried who has similar family circumstances to me (the sole household earner with two children under the eligible age of childcare support) to tell me the last time they knowingly worked for £6.87 an hour. I welcome anyone salaried who has a similar career background to Laura and I (cumulatively two BA’s, two MA’s, a PhD, a teacher training qualification, training in Specific Learning Difficulties, accountancy and book-keeping training, experience in dance, theatre and the visual arts, experience running organisations, over 15 years experience freelancing and over 10 years facilitation experience) to tell me the last time they knowingly worked for £6.87 an hour. I really hope it was a long time ago. I want to be quite emphatic in pointing out that we did not work extra hours because The Yard (our sponsor) forced us, or expected more of us. But at the same time I am fairly tired of the framing that it is my choice and that we could just, at any point, stop working if the paid time runs out. This is not quite how it works. With jobs with concrete outcomes it is easier to understand where you are in relation to the outcome, what has led to more time being required than expected. With Task Force the job was to attend industry meetings, understand and advocate for better practice for working with freelancers. This amorphous role brings with it an element of being “on Task Force duty” as often as you possibly can. If we didn’t attend a meeting, we might miss something that is being announced or changed. There is no wider company briefing for this that will bring us up to speed, or a colleague we can chat to in passing in the office. Like with all of our practice as freelancers, if we don’t know something, we are just behind, and therefore just not as good at our jobs. As producers it is our job to know the nuance of the shifting Arts Council England guidelines, or the percentage of successful applicants to a niche charitable fund, or have the most insight possible into almost opaque programming procedures. We do that entirely out of “project” time and therefore unpaid. We all do it by having our ear to the ground all day and night, seven days a week. All of us. This is a massive waste of human labour. That won’t change without transparency and better communication from organisations and funders and very different processes across the sector. If we didn’t do this unpaid labour we wouldn’t be in a position to take on the paid labour and we wouldn’t be very good at our jobs. But we are. Very good, and very tired. Having said that, in a push to ensure that we are not undermining the wage capacity of ourselves and others in the workforce, and as part of a promise made during our recent DIY workshop, Laura and I have committed to finding ways to practice in a manner that ensures all activity is paid for. We’ve begun this process through a timesheet system and protocols for accounting for time. In the interim we will be balancing on our privileges to ensure different methods of accessing money to complete this work. For example, residency and training time for arts support workers in which we could focus on all the peripheral work that is necessary but doesn’t feed into one specific outcome. Another example is working with organisations to streamline their processes when working with artists and those in supporting roles so that the burden of administrative responsibility is not placed unduly on to freelancers. At some point it’s going to mean us all being a bit more honest around what funders, donors and ticket buyers are getting for their money. I know the workload within organisations is also huge. But if that means that the majority of people working in the sector are overworked and underpaid it is our duty to change the sector right now. We must diligently and transparently articulate why difficult decisions and a culture shift are necessary to make it a sector to be proud to work in. As demonstrated in the data collected in the Freelance Task Force Producer Survey, 73% of independent producers are subsidising their producing with other work and benefits. If the subsidy is with benefits (as it has been in my own case) this is a wildly distracting way of distributing public money when UBI is so frequently scoffed at. If it is with other work this is perpetuating ableist, classist and gendered practices. This is very much the case when only 46% of people claim to work part-time hours on their producing. That means 54% of people are working full time hours and presumably at least 27% (but anything as much as 54%) are working full time hours and still needing to subsidise their producing with other work and benefits. Why would anyone want to promote this as a style of work to future generations? Some of these considerations and many more led us to producing the Freelance Supporters Menu during our Task Force time. Producing the menu during this time threw up another difficult, albeit somewhat expected, realisation connected to the perception of our work. Truthfully the Freelance Supporters Menu is mostly made up of thoughts Laura and I had discussed well before 2020 and Covid and more visible or more publicly discussed economic disparity. We have been considered outspoken (with all the gender connotations attached that this particular adjective), extreme and radical. Now that these same thoughts have been disseminated to organisations cloaked in the little power jacket of Task Force, organisations have described the provocations as "vital", "useful day-to-day", "brilliant", "a gift", "thought-provoking", “superb” and “sector-changing”. It is not lost on us that they feel that a little bit of their buy in has made these thoughts worth hearing. Of course, there has been some disdain at the contents of the menu. No one has come to us directly, which we'd welcome, but we've heard tales that one building director felt it went too far and was unfair for them as a director. I am truly sorry for any moment that a person feels upset, which is why we wrote the menu, anchored in kindness, for a more equitable future practice for more people. And, of course, the public show of appreciation for a document, and the undertaking of the work suggested within that which is necessary to make change, are two different things. Being able to tweet a worker-centred "radical" aphorism whilst simultaneously making secret redundancies isn't a skill set I admire, not that anyone asked my opinion. I guess I don’t have a neat summary for the experience of working on this quite unique, quite powerful experiment. It has exposed a tendency for individuals to seek to replicate damaging behaviours when they centre themselves. It has also shown that within 13 days you can demand better access for more people (this wasn’t done perfectly, but the beginnings of a better way of working were begun); you can have BSL interpreters and captioners at every meeting; you can work in creative and complex ways remotely; you can have productive meetings entirely centered on wellbeing and care; and you can disagree and have different outcomes and still value and welcome plurality. To end on the most positive note I can, in the final “Burn It Down” meeting, we discussed the way this had become a space of friendship between two dimensional heads and shoulders, scattered across the country and even the continent. Gillie Kleiman shared a text by carla bergman and Nick Montgomery titled Joyful Militancy: Building Resistance in Toxic Times. The dedication at the front of this book spoke to me as a gratitude to all of those individuals who have dedicated their mid-pandemic summer to advocating for, what they believe to be, a better life for more people. To everyone in cramped spaces and stifling atmospheres

letting in fresh air and finding wiggle room embracing messiness and mistakes together learning to move with fierce love and uncertainty making us capable of something new

During our time so far on the Freelance Task Force, we've worked to collate 'A Freelance Supporters Menu' to reflect some of the thinking and research that could offer provocation to arts organisations to reflect on how freelancers can be better supported.

This is draft 1, created at the 9 week mark of 13, so we plan to update this to more fully reflect the whole Task Force process at the end. Please watch this video for an introduction to the Menu and then you can download 'A Freelance Supporters Menu' in full from the link below. Closed captions are available on the video. Super pleased to announce that we are hosting one of the iconic Live Art Development Agency DIY's this year! DIY 2020: Doing, Undoing...And Doing Again

8,9,10 September Ashleigh Bowmott and Laura Sweeney A 3-day remote retreat for six freelance producers, curators and arts administrators who have had to undo their present and future work due to COVID-19. It will be a guided staycation which allows space to those who ‘support’ Live Art, to reflect on “business as usual”, get some much deserved socially-distanced nourishment, and the collective development of radical terms and conditions. This DIY is run in partnership with ArtHouse Jersey. About the workshop We will work together for 3 days in a row: Day 1: Doing The old ways of working – now we have a moment to reflect, how were we working before? What aspects of our roles felt like they were going well? Which bits were absolutely dreadful? Day 2: Undoing A much-deserved day off – a self-care day, where we undo the expectations we have put on ourselves to support as many people as possible, often at our own expense. Day 3: …And Doing Again Work will return soon – how can we make changes before we fall back into our old ways? What is within our power to change? What will be our terms and conditions for going to work? Where? In your house Money? Each participant will be given a stipend of £140 to take part. How do I apply? Visit the LADA website and fill in the v short application form by 5pm, Sunday 23 August 2020.

EDIT ON 22nd JULY: the templates are now uploaded on this page - see above

----- Today Arts Council England have shared the guidedance for the re-opening of Arts Council National Lottery Project Grants. It opens again on 22nd July and we'll add an updated template here once the portal is open, but in the meantime, here are the changes in guidance to the previous format of Project Grants. Read the full supplementary guidance on ACE website here. Overall budget for this funding £59.8m until April 2021 Who is this for? There is a particular focus on individuals for this grant in this time. Other eligibility criteria remains the same. How much can I apply for? This grant strand remains split into under £15,000 and over £15,000. ACE will manage their budget across the entire time period, so don't rush to apply straight away if you're not ready. What is the turnaround? Standard 6 weeks for an under £15k and 12 weeks for an over £15k, but they will try to speed this up where possible. What can I apply for? "Because of the circumstances during this COVID-19 period, we will be particularly keen to support: • applications from individual creative practitioners (including time to think and plan) • research and development activity • organisational development activity • live activity that can be safely delivered within this period (rather than activity with a start date far in the future) • activity that closely aligns with our Equality Objectives" Are the questions different now? Still asking the same questions around the 4 criteria: Quality, Public engagement, Finance and Management. But they acknowledge that your answer may be different now and are therefore looking at applications with flexibility and openness. Audiences ACE are aware that audience numbers may be lower, and audiences may not even be part of this phase of your project, but instead you can talk about how they may be engaged in the longer-term. Match funding Normally you would need at least 10% match (unless in very special circumstances) - although we know that to be successful this generally sat at around 40-50% match... This has been relaxed, so you no longer need to have any match funding to qualify, however if you do have any cash, support in kind or a mix, still add it into the budget. Risk Management Plan compulsory on offer of grant "We’ll ask everyone who is offered a grant in this period to confirm that they have an appropriate risk management plan in place and that they are able to follow all current UK Government guidance on COVID-19. Our Terms and Conditions set out grantholders’ responsibilities around adhering to UK Government guidance." What are the Equality Objectives? The link from their PDF is broken but we think it would be this document here. "We see diversity as an opportunity. We want to see an inclusive approach remove barriers to entry, discover new talent, raise the bar for artistic excellence, inspire innovation and spark new collaborations; we want to see our stories and experiences as a nation shared across our stages, our galleries and our public spaces. We believe that equality and diversity should be embedded in all aspects of art and culture, which is why we’ve made the Creative Case for Diversity a central part of our funding agreements." Can I ask ACE for help? They are currently looking at how they can best use their resources for advice giving 'focusing in particular on those who are represented in our Equality Objectives" |